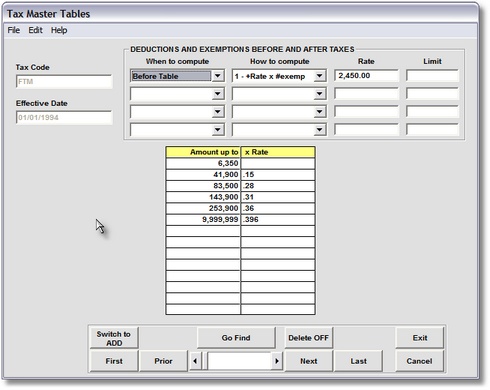

Help! My WMR status bars have disappeared If you cannot use the above method, you can call the IRS. This lines up with the cycle codes as discussed in this video. However, major updates on daily account are generally on Tuesdays and mass updates on weekly accounts are usually on Fridays.

Similar to WMR and IRS2Go your free IRS Tax transcript can get update any day of the week. IRS batch processing generally takes place 12am to 3am (EST) and refund direct deposit processing takes 3:30am to 6:00am (EST) – most nights, expect Sundays. They may also see missing status bars because of this, as discussed in the next section below. However during the peak of tax season it is not uncommon to see longer outages.įurther when too many users are on or attempting to access the refund trackers, the IRS can restrict access to these tools and people sometimes see the message that system cannot verify their identity. WMR and IRS2Go are however down for scheduled system maintenance on Sunday and Monday nights per the screenshot below. So knowing which one you are in can given you some guidance on where your return processing and WMR/IRS2Go updates are likely to happen. The IRS has older systems and does most of its processing in “batches” or “cycles.” This will generally show which batch or cycle your return and refund (if applicable) is being processed in the IRS master file (IMF). You can see if your IRS account is daily or weekly in this article. However, major updates on daily accounts are usually Wednesday and major updates on weekly accounts are usually Saturday.

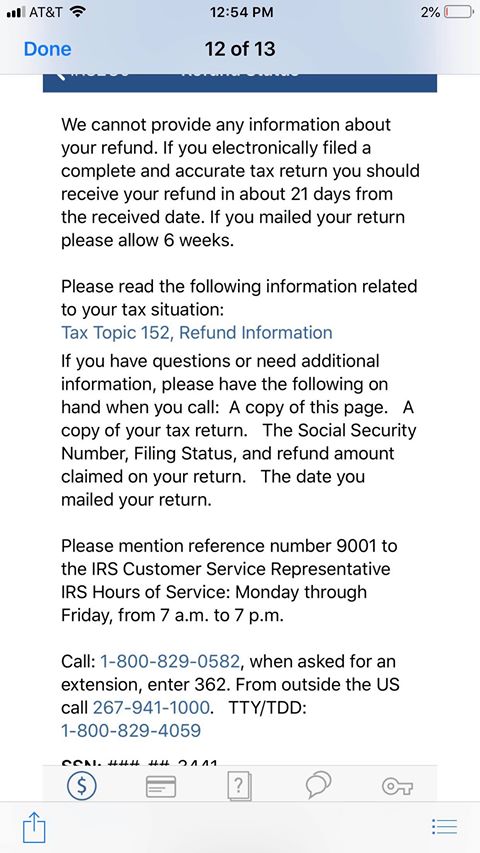

The WMR website and IRS2Go mobile app can update any day of the week. When do IRS2Go/WMR & Transcript Get Updated For Tax Return and Refund Processing? So ensure your tax return is as accurate when filing. This could add days, weeks and even months if lots of additional information is need. You can also check your IRS tax transcript for details. While some information is provided on WMR and IRS2Go, the IRS will generally mail you for further detailed information.

This delay is what frustrates most tax payers as the IRS does at times provide limited information if errors in your return are spotted. While the IRS does promise that it will process most returns in under 21 days, it could take longer if complications come up. If you elected the direct deposit (DD) option for your refund, you will get a date by which it should be credited to your account. A personalized refund date will be provided and the WMR status will now be Refund Approved. This status will appear if your tax return checks out and and your return has been approved for payout by direct deposit or check.

IRS Refund Processing Delays (after received) WMR Status Bar 2: Refund Approved

0 kommentar(er)

0 kommentar(er)